One of the biggest impediments to the growth of a business is not having sufficient funds to support the increase in activity. Entrepreneurs in India consistently struggle to raise timely credit from banks.

Many companies especially MSME’s cannot comply with risk adverse procedures of banks due to lack of collateral, low equity base and lack of adequate cash flows. Restrictive lending policies, inflexible collateral requirements, and slow disbursement times by formal financial institutions leads to under financing.

Our Mission is to bridge the financing gap by providing flexible and innovative financial products in an efficient and customer friendly manner.

View More

Finance is enabler of growth opportunities and thus has a big impact on business growth. SME business sector contains high levels of potential growth opportunities and rapidly expanding business operations.

Entrepreneurs and business owners are required to make several decisions regarding growth opportunities, developing business strategies and financing these situations. Selection of the right type of financing is thus very important.

Auctus in Latin means Growth. Our company name represents our entrepreneurial mindset focusing on partnering with our clients and assisting them to achieve "Sustainable Growth" by offering tailor-made financing solutions.

MSME’s operate under severe constraints wherein the promoter/top management focus is on core business functions. This results in lack of focus on strategic and financial planning. Thus many organization do not reach their full potential and fail to grow.

Our Corporate Finance Advisory services assist clients in developing and implementing their strategic objectives. The focus is on assisting the client’s management to clearly outline various aspects of the envisaged business and chart-out the business growth path.

We also assist companies in determining business/company value for M&A transactions, VC/PE deals, etc. using various methodologies like DCF, Relative Valuation, etc.enabling our clients to make sound divestment/investment decision at the right valuation.

Based on the strategic plan of the company –

A combination of our expertise in the field of corporate finance and the in-depthknowledge & experience of financial modelling & valuation, allows us to uniquely deliver value to our Clients.

Translates strategic direction into a structured document based on detailed discussion with the management team and comprehensive research.

Includes preparation of a detailed financial model with P&L, Balance Sheet & Cash flow projections.

Preparation of comprehensive & flexible financial models (in MS Excel) with sensitivity analysis.

Could be used to monitor project costs, cash flow analysis, scenario analysis, etc.

Preparation of feasibility studies to assess financial viability of a new project/investment opportunity.

Determining business value for corporate transactions, capital investments and shareholder value management using different methodologies (DCF, Relative Valuation, etc.)

We assist companies in raising capital i.e. debt and/or equity, by leveraging our extensive network of relationships with lenders and equity investors.

Focus is on providing innovative solutions to meet financing needs of SME’s moving away from the traditional banking solutions. The services include:

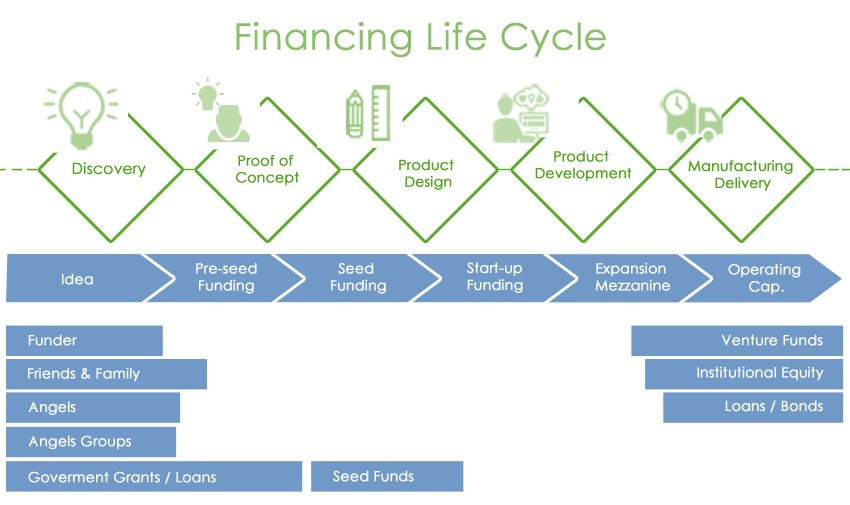

Companies need external equity capital at different life cycle stages to capitalize on the various growth opportunities available. With our broad and deep understanding of Companies and their business model and wide network of investors, we not only assist companies in raising growth capital but also ensure that their long term objectives are met.

View MoreM&A drivers could be customer acquisition and top line growth, new market entry or competence building. We assist our clients achieve their strategic objectives through M&A and accordingly advise on both buy-side and sell-side. We offer end-to-end assistance for M&A deal.

View MoreCompanies have varied funding needs at various life cycle stages. Debt does not dilute the owner’s ownership interest and is thus the preferred source of financing compared to private equity. However it is of paramount importance to assess the debt need appropriately and structure the same keeping in mind the company’s ability to timely service the same.

View MoreWe provide a range of real estate transactional advisory services across core sectors of office, retail, industrial, education and hotels. We work with many of the country’s leading developers, property owners and investors. Key service offerings include -

Lease Advisory (Landlords and Tenants)

Assist landlord and occupier clients in identification of properties which align with their business objectives

Focus on lease advisory/management contracts for hospitals, school projects and hotels

Acquisitions and Disposals

Advisory services for purchase/sale of larger parcels of industrial, residential and commercial lands; hotel and hospitals. It includes – identification of properties, inspections of suitable premises, negotiations and liaisoning with legal advisors

3F/4, Vanessa Plaza, near Ambe Vidhyalay,

Manjalpur, Vadodara – 390010

Tel: +91 9574 130 009

Email: [email protected]